This site contains affiliate links, view the disclosure for more information.

In this article, we share our favorite finance books to read in your 20s. At ReysUp, we believe in the importance of early financial planning and that starting your planning in your 20s is a must.

Starting your financial planning journey in your 20s can set the foundation for a lifetime of financial stability and success. After all, it’s in your 20s when you typically enter the workforce for the first time, gain financial independence, and make significant life decisions that will influence your future. There is truly no better time to start thinking about financial health and security.

That said, it’s often a daunting topic for most 20-somethings. Early financial planning involves understanding budgeting, saving, investing, and retirement planning, but oftentimes these concepts are overly complicated by financial professionals (mostly because they want you to feel like you need to pay them to manage your money for you).

Want to know a little secret? You can totally do this on your own. You just need to know where to go, what books to read, and what resources to help you get there. That is where we (and this article) enter the picture.

By establishing a strong financial base early on, you can avoid common pitfalls, reduce financial stress, and achieve your long-term financial goals. Let’s get into it!

Top 5 Personal Finance Books to Read in Your 20s

1. “Your Money or Your Life” by Vicki Robin and Joe Dominguez

Category: Budgeting & Saving

“Your Money or Your Life” is a transformative book that challenges readers to rethink their relationship with money. Vicki Robin and Joe Dominguez present a nine-step program to help you track your finances, reduce expenses, and find greater fulfillment in life. The book emphasizes the importance of living frugally and making conscious spending choices. It’s an excellent read for those in their 20s who want to take control of their finances and align their spending with their values.

2. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

Category: Budgeting & Saving

This classic book debunks the myths surrounding wealth accumulation and highlights the habits and behaviors of self-made millionaires. Stanley and Danko’s research reveals that most millionaires live below their means, invest wisely, and prioritize saving over spending. “The Millionaire Next Door” offers valuable insights into the importance of frugality, budgeting, and long-term financial planning. It’s a must-read for young adults aiming to build wealth through disciplined financial practices.

3. “Rich Dad Poor Dad” by Robert T. Kiyosaki

Category: Investing

“Rich Dad Poor Dad” is a must-read book on personal finance and investing. Robert Kiyosaki shares the lessons he learned from his two “dads” – his biological father (Poor Dad) and the father of his best friend (Rich Dad). The book contrasts the financial philosophies of these two men and provides actionable advice on investing, entrepreneurship, and building wealth. It’s particularly valuable for young adults interested in learning about the basics of investing and the importance of financial education.

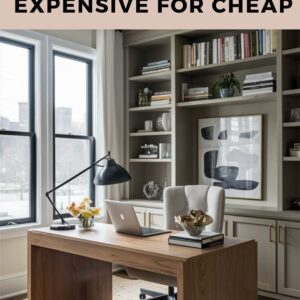

Expert Work from Home Tips: Smart and Practical Desk Setup

4. “The Simple Path to Wealth” by JL Collins

Category: Investing

JL Collins wrote “The Simple Path to Wealth” as a guide for his daughter and later turned it into a comprehensive resource for anyone looking to achieve financial independence. The book covers fundamental investing principles, the power of compound interest, and the benefits of low-cost index fund investing. Collins’ straightforward and practical advice makes this book an essential read for young adults starting their investment journey and aiming to build long-term wealth.

5. “The Bogleheads’ Guide to Retirement Planning” by Taylor Larimore, Mel Lindauer, Richard A. Ferri, and Laura F. Dogu

Category: Retirement Planning

Retirement planning is often overlooked by 20-somethings, but starting early can significantly impact your financial future. “The Bogleheads’ Guide to Retirement Planning” offers detailed advice on retirement accounts, investment strategies, and tax considerations. Written by members of the Bogleheads community, the book emphasizes the importance of starting early, investing wisely, and understanding the various aspects of retirement planning. It’s an invaluable resource for those in their 20s who want to secure their financial future and nestegg.

Bonus: “The Psychology of Money” by Morgan Housel.

Category: General Financial Planning

“The Psychology of Money” by Morgan Housel explores the intricate relationship between people and money, focusing on how behavior and mindset impact financial decisions. Through engaging stories and insights, Housel highlights the psychological factors influencing money management, such as risk perception, greed, and fear. This book is particularly valuable for people in their 20s as it provides essential lessons on wealth, happiness, and investing, emphasizing the importance of understanding and improving your financial behavior early in life.

Additional Resources for Learning About Personal Finance

In addition to these books, there are numerous online resources available to help young adults expand their financial knowledge:

1. Personal Finance Blogs

- Mr. Money Mustache: Offers practical advice on frugality, saving, and investing for financial independence.

- NerdWallet: Offers comparisons of financial products, advice on managing credit, and tips for improving financial health.

2. Online Courses and Webinars

- Coursera: partners with universities and organizations to offer a wide range of courses, specializations, and degrees, often with a focus on academic and professional development

- Udemy: Provides a vast marketplace of courses created by individual instructors, catering to a wide array of subjects with a practical, skills-based approach

3. Podcasts

- “The Dave Ramsey Show“: Offers practical advice on debt reduction, budgeting, and wealth building.

- “Afford Anything“: Hosted by Paula Pant, this podcast covers a wide range of personal finance topics, including investing, financial independence, and real estate.

- “BiggerPockets Money Podcast“: Focuses on real estate investing, financial independence, and wealth-building strategies.

4. YouTube Channels

- Graham Stephan: Provides insights on real estate investing, personal finance, and entrepreneurship.

- The Financial Diet: Offers practical advice on budgeting, saving, and managing money.

- Andrei Jikh: Covers topics related to investing, stock market analysis, and financial literacy.

Other Practical Money Tips for Young Adults

Conclusion

Starting your financial planning journey in your 20s can set you up for a lifetime of financial success and security. By reading the right books, utilizing online resources, and implementing practical financial strategies, you can build a strong financial foundation. Remember, the habits and decisions you make now will significantly impact your financial future. Take control of your finances today and work towards achieving your financial goals and dreams.